New research sheds light on Medicare reimbursement challenges, and how physicians can prepare for a more secure financial future

Medicare reimbursement has been a longstanding concern for U.S. physicians, and these financial restraints have now come to an inflection point.

In the 2025 Medicare Physician Fee Schedule, the Centers for Medicare & Medicaid Services (CMS) confirmed a 2.9% reduction in average payment rates.1 This recent cut, combined with complex payer rules, updates to Medicare Advantage and Part D, delayed payments, obtaining prior authorizations, and resubmitting claims after a denial, contributes to the mounting challenges physicians today face with healthcare reimbursement, and more broadly, their organization’s long-term financial health.

But by pinpointing these core challenges early on, physicians across specialties and practice sizes can more easily identify areas where their reimbursement process or revenue cycle might be broken — and proactively plan for shifting reimbursement rates in future.

Let’s examine some recent data on how physicians perceive these financial strains, and what organizations should know to better prepare themselves for policy shifts.

How physicians today feel about Medicare reimbursement rates and healthcare reimbursement issues

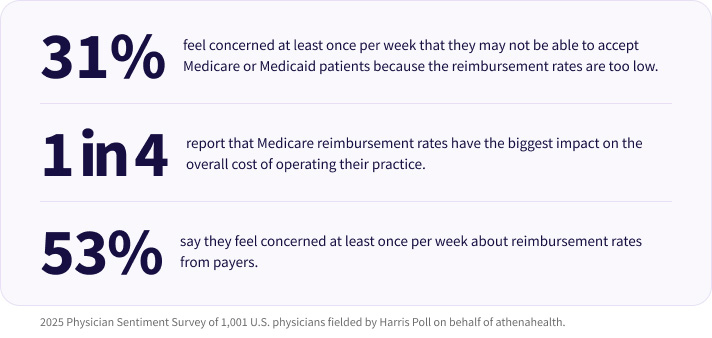

Recent data from the 2025 athenahealth Physician Sentiment Survey confirms healthcare reimbursement remains a pain point for healthcare practices of all sizes:

- Almost one third (31%) of physicians say they feel concerned at least once per week that they may not be able to accept Medicare or Medicaid patients because the reimbursement rates are too low.

- One in four (25%) report that Medicare reimbursement rates have the biggest impact on the overall cost of operating their practice.

- Over half (53%) say they feel concerned at least once per week about reimbursement rates from payers.2

Whether you’re in a small rural clinic or a large multispecialty group, the math is getting harder to make work.In many cases, the root of financial strain isn’t clinical inefficiency— it’s revenue cycle challenges and unpredictable cash flow. Concerns about reimbursement rates from payers may reflect larger issues with staying on top of medical billing and coding changes, documentation requirements, and the measurement and reporting required for value-based care (VBC) models.

The impact of declining Medicare reimbursement rates

When Medicare reimbursement rates shift, so does a practice’s ability to fund daily costs and operations. Concern from physicians about declining reimbursement rates could have negative consequences down the line, leaving Medicare and Medicaid patients severely underserved in the future.

One of the most distressing realities for physicians and doctor-owners is that Medicare reimbursement hasn’t kept pace with the rate of inflation—and therefore doesn’t reflect the true cost of care delivery.

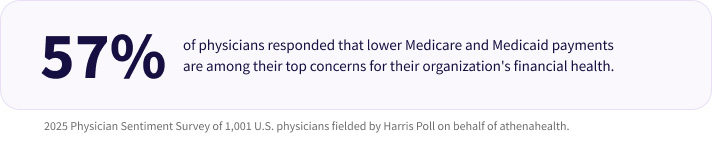

- When asked about their top concerns for their organization’s financial health, 57% of physicians responded with lower Medicare and Medicaid payments.3

This growing disconnect between the cost of care and reimbursement isn’t just frustrating — it’s financially unsustainable. Fortunately, some lawmakers seem to be taking note.

A recent announcement from CMS states, “Payments from the government to Medicare Advantage plans are expected to increase on average by 5.06% from 2025 to 2026. This is an increase of 2.83 percentage points since the 2026 Advance Notice, which is largely attributable to an increase in the effective growth rate.”4

This much-needed adjustment has potential to be a big step forward for policy makers in addressing the needs of physicians and our greater healthcare system, and could have a positive impact on bridging the financial gap for practices across the country.

Regulatory shifts pose another moving target for physicians

Each year, the Centers for Medicare & Medicaid Services and Congress adjust rules that directly affect how physicians are paid. And while these fee schedule updates are part of the larger movement to help the U.S. healthcare system shift toward focusing on care outcomes and VBC, they often introduce more complexity without adequate support to help practices keep up.

According to Medical Economics, policymakers and lawmakers across political parties often scrutinize changes to the physician fee schedule for their impact on practice viability and federal spending.5 Some suggest that even under MACRA, the rising costs of care and rates of inflation don’t match reimbursement rates, making this a bipartisan challenge to address an unsustainable healthcare economy.

Regulatory changes create an ever-shifting landscape that clinicians struggle to navigate in order to get paid quickly and with the full amount. Physicians who wish to forge the foundations for a more durable and financially viable practice must do their best to understand the political and economic nuances that drive these regulatory shifts and policy changes in the years to come.

According to the 2025 Physician Sentiment Survey, 57% of physicians say that lower reimbursement from Medicare and Medicaid is among the biggest concerns they have about the financial health of their organization.

What physicians should know to prepare themselves for upcoming shifts in reimbursement policies

Physicians must continue to stay on top of these updates, or lean on a trusted partner, to understand the implications for their practice's financial future.

Here are a few tips for physicians to help navigate these shifts:

1. Stay up to date on policy updates and regulatory changes

Regulatory and documentation requirements often make day-to-day work more difficult for physicians, and compound clinician burnout. MIPS compliance, local reporting requirements for prescriptions, changes to Medicare and Medicaid fee schedules, and payer-specific medical codes are all key factors that make it difficult for physicians to keep up with bureaucratic demands.

This burden not only negatively affects physicians, but it can also adversely affect patient care, taking up valuable clinician time that could otherwise be spent on bettering care outcomes. While physicians can’t control regulatory changes, staying informed on what’s coming can help. athenahealth’s Government and Regulatory Affairs team helps educate our customers on the latest updates, with educational webinars and newsletters that help practices better navigate policy shifts.

2. Assess Participation in VBC models

Shifting toward value-based care models could help practices better weather policy changes, as long as they tailor their clinical workflows and get proper patient medical data for value-based care reporting. Traditional fee-for-service (FFS) models pay per visit or procedure, and when Medicare lowers reimbursement rates — as it has regularly done in recent years — practices earn less for the same services.

VBC programs, on the other hand, reward quality and patient outcomes over volume. This opens the door to bonuses and shared savings, giving practices the opportunity to earn more by delivering effective, efficient care. Some VBC models offer per-member-per-month payments or bundled payments, allowing for a steadier flow of revenue. This can help reduce dependence on visit volume and offset the volatility caused by declining Medicare FFS reimbursements.

Medicare and CMS both aim to accelerate the shift to VBC with initiatives like Accountable Care Organizations (ACOs) and Primary Care First. Practices that adopt VBC can now develop the infrastructure, workflows, and analytics capabilities needed to succeed—and avoid being left behind as payment models evolve.

3. Track and optimize RCM metrics to help capture full reimbursement

Certain payer-specific RCM metrics like Denial Rate, Clean Claims Rate, and First Pass Resolution Rate can give your practice a better idea of how smoothly your daily revenue cycle is functioning, and which areas need improvements. athenahealth Insights Dashboards can offer a clearer picture of your organization’s financial health and assist in monitoring practice performance and reimbursement rates with real-time analytics. Proactive measurement and benchmarking help your practice better understand where you can optimize for full reimbursement, where you can speed up the RCM process, and measure the overall cost of care.

4. Partner with an ACO to tap into shared savings

Joining an ACO can be a helpful way for independent practices to offset decreasing Medicare reimbursements. By collaborating with an ACO, your practice can share the financial rewards of delivering high-quality, coordinated care through quality programs, especially those run by Medicare and Medicaid.

To make it easier for healthcare organizations to share risk and resources for accountable care, athenahealth created Platform Services for Value-Based Care, which helps match practices with compatible ACOs and connects them through built-in data exchange and reporting tools. You can browse potential partners in the athenahealth Marketplace and integrate tools directly into your existing athenaOne® workflows — helping you reduce administrative effort while accessing new revenue opportunities.

Don’t go it alone: athenahealth can help you navigate reimbursement complexities.

For physicians across the U.S., reimbursement isn't just a line item, it’s a defining factor in the overall ability to practice medicine. While much of the landscape is outside a single physician’s control, staying informed, investing in operational resilience, and working with an experienced healthcare IT partner in your corner can help you stay one step ahead of reimbursement instability.

Whether you’re a solo practitioner or part of a large healthcare organization, athenahealth can help you proactively prepare for what comes next, and staying one step ahead is the most effective antidote to reimbursement instability.

Ready to learn more about how athenahealth helps your practice with quicker and easier reimbursements? Read our guide to Making the Most of MIPS.

More athenaInstitute resources

Continue exploring

1. CMS. (2024, November). Fact Sheet: Calendar Year (CY) 2025 Medicare Physician Fee Schedule Final Rule. https://www.cms.gov/newsroom/fact-sheets/calendar-year-cy-2025-medicare-physician-fee-schedule-final-rule

2. 2025 Physician Sentiment Survey of 1,001 U.S. physicians fielded by Harris Poll on behalf of athenahealth.

3. 2025 Physician Sentiment Survey.

4. CMS. (2025, April). CMS Finalizes 2026 Payment Policy Updates for Medicare Advantage and Part D Programs. https://www.cms.gov/newsroom/press-releases/cms-finalizes-2026-payment-policy-updates-medicare-advantage-and-part-d-programs

5. Medical Economics. (2025, February). Medicare reimbursement rates explained: Why they keep declining, and what the future holds. https://www.medicaleconomics.com/view/medicare-reimbursement-rates-explained-why-they-keep-declining-and-what-the-future-holds