Value-Based Care

Simplifying value-based care at every stage

Transitioning from volume to value-based care brings new risks and opportunities. athenaOne’s native VBC capabilities can help improve patient outcomes with better informed care while enabling you to track and get paid for the quality care you provide.

The right data, when and where you need it

Data gaps can undermine care coordination, patient outcomes, and lead to needless costs. athenaOne’s single-instance platform exchanges data across the healthcare ecosystem and surfaces it in your workflow, making it easier to deliver exceptional care.

Enhance care and coordination

Exchange patient data in near real-time across our network of national and local healthcare entities to enable improved care coordination and address care and diagnosis gaps.

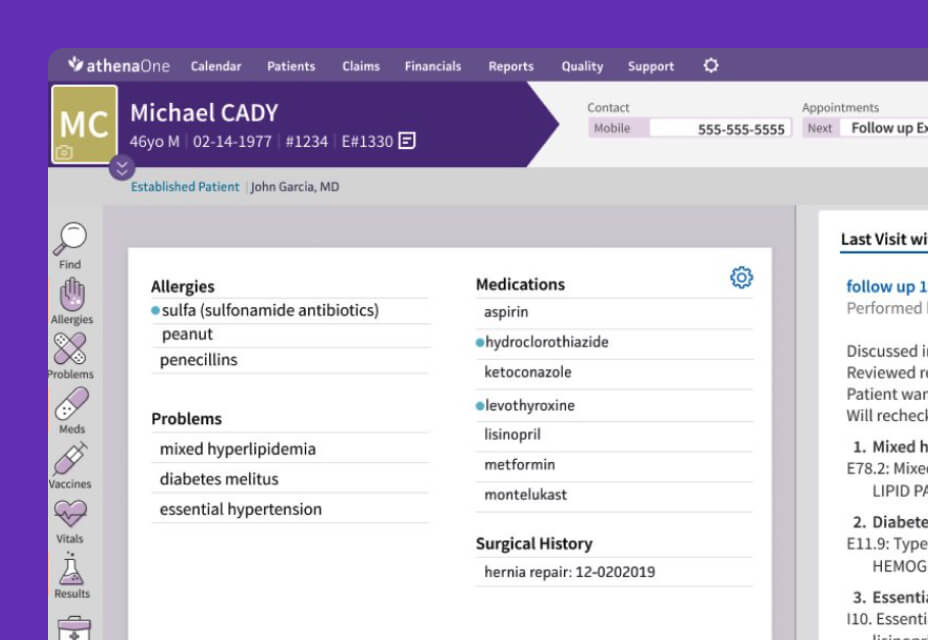

Comprehensive patient data that’s actionable

Make better informed decisions with external data that’s been curated, integrated into the patient chart, and surfaced within your workflows during the encounter.

Automate wellness outreach

Improve your quality performance and efficiency by letting athenaOne automatically identify and contact patients in need of wellness visits and other important preventative care.

Improve ACO connections

Drive VBC success by automating your data exchange with ACOs through fully integrated solutions from our Marketplace.

athenaOne

Support for financial success

Being accountable for outcomes, risk levels, and cost efficiency across populations are new challenges for many practices. athenaOne offers tailored support, training, and embedded tools that help drive VBC program success.

Training that enables success

athenaOne includes tailored support, training, and consulting services with our solution to help you establish best practices and navigate regulations.

MIPS performance support

Receive end-to-end support through technology, insights, and expertise that make succeeding in MIPS easier than ever.

Simplify CCM identification

Automate your CCM process to filter and surface patients with a valid enrollment status who haven’t had a claim billed.

Optimize program performance

Improve tracking and quality measure performance with point-of-care quality and care gap alerts, and native, flexible reporting tools that update in near real time.

Ease the burdens of value-based care

Participating in VBC comes with significant administrative burdens from shifting policies to increased reporting needs. athenaOne provides software, services, and support that help reduce these burdens, freeing practices to focus on delivering exceptional care.

Automatic updates

Program and measure updates can happen automatically, ensuring you have the latest HCC Model, MIPS logic, and HEDIS and other quality measures.

Relief from submission work

Let athenahealth take on the burdens of submission and audit support for your MIPS and MSSP quality programs, freeing your staff for other work.

Improve HEDIS performance

athenaOne maintains current HEDIS measure certification with NCQA, so you can monitor your performance in near real time throughout the year.

athenaOne helps drive success in value-based care

Of eligible athenaOne users achieved positive payment in the MIPS program compared to 79.26% nationally.1

MIPS and MSSP submissions completed on behalf of customers in the performance year 2024.2

Hours of practice work saved by athenaOne managing MIPS and MSSP submissions in Performance Year 2024.3

Learn more about value-based care

Hear how athenaOne is making VBC easier

It’s no secret that data is essential to VBC success. Hear how the data and visibility that athenaOne provides helped transform Your Health’s patient care.

Technology that supports your success

1. Results from 2022 Quality Payment Program Experience Report (QPP-cms.gov).

2. Includes MIPS and MSSP program submissions for 2024. Each category of MIPS counts as one submission.

3. Estimated based on athenahealth data of 40K total client submissions with 3 hours of work per submission in 2024.