FEATURED| TRENDING WITH READERS

MORE INSIGHTS

6 Ways Your Large Practice Can Begin Integrating AI Technology to Drive Efficiency

To highlight the critical results of this research, we're examining the top use cases for AI technology that physicians believe they can benefit most from.

Moving Beyond Basic Data Exchange to Deliver on the Promise of Interoperability

Moving Beyond Basic Data Exchange to Deliver on the Promise of Interoperability

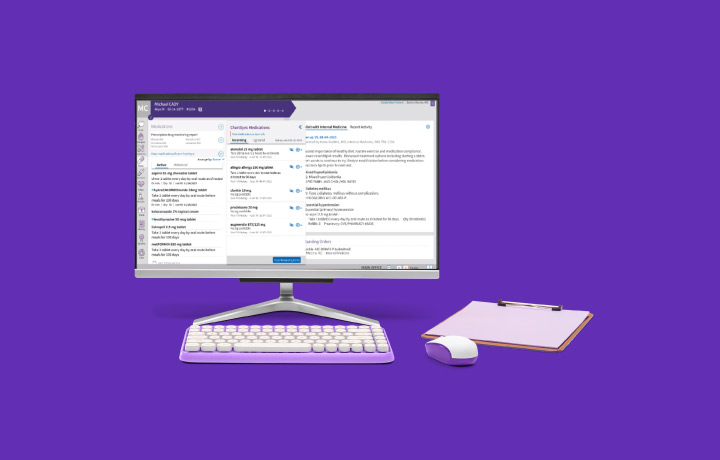

5 Ways the Right EHR Can Streamline Urgent Care

Increased demand for urgent care calls for top-notch EHR systems. Learn which features bring the most benefits to your organization.

Key ways your healthcare organization can use technology to simplify value-based care

Key ways your healthcare organization can use technology to simplify value-based care

Selecting the right technology for your podiatry practice

Selecting the right technology for your podiatry practice

EDITORS' PICKS

Article

What is quality in value-based care?

Article

Value-based care requires a thriving community-based healthcare ecosystem

Article

Leveraging technology to simplify value-based care – Tracking submissions and measuring performance at Oaklawn Medical Group

Article

Elevating the patient experience through data partnership

Article

Fostering accessible healthcare practices across modalities

INFOGRAPHICS

Infographic

A Quality Payment Program update

Infographic

How physicians' attitudes on the healthcare industry differ by specialty

Infographic

Breaking the burnout cycle

Infographic

5 ways to engage and support patients with chronic conditions

Infographic

The plight of the PCP

Infographic

Prior authorizations, explained

Infographic

Optimizing patient flow