Article

Ah, spring: The season of patient payments

By Chris Hayhurst | April 4, 2017

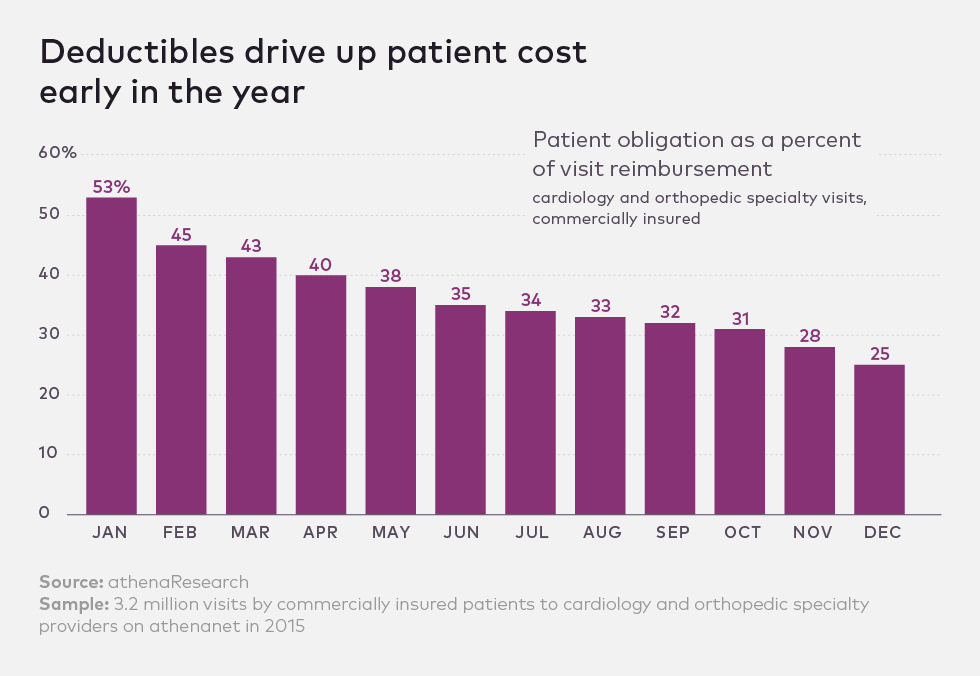

An analysis of 3.2 million patient visits to cardiology and orthopedic specialists found that patient obligations are at their highest early in the year, presumably because most patients haven't hit their deductibles.

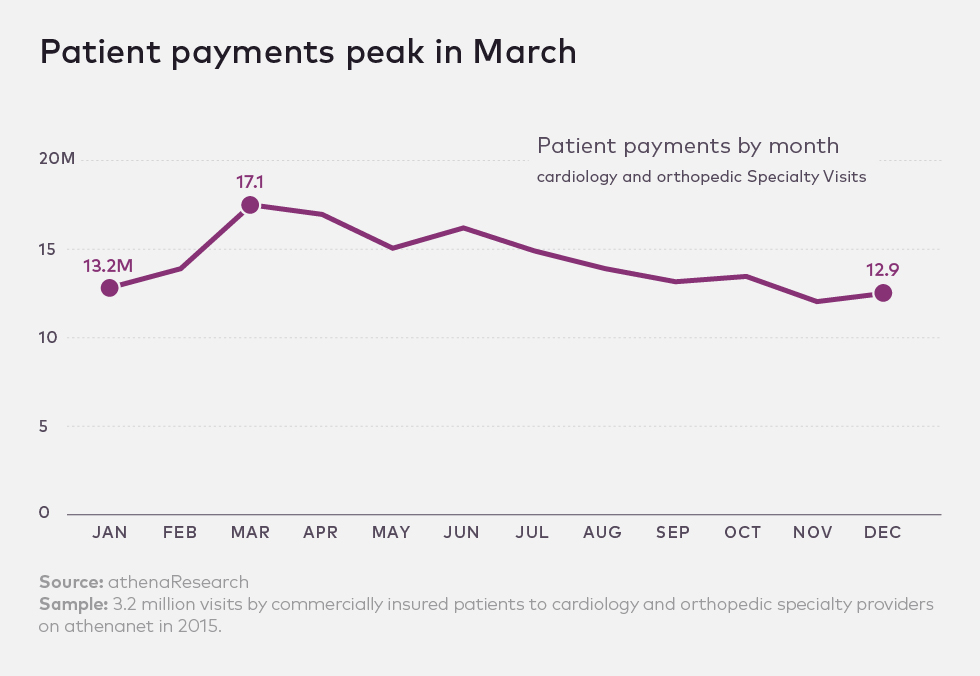

While patients are responsible for more than half of their visits' full costs in January, they pay just 25 percent of those costs in December, the data show. The spring months represent the peak for patient payments, which are 33 percent higher in March than in December.

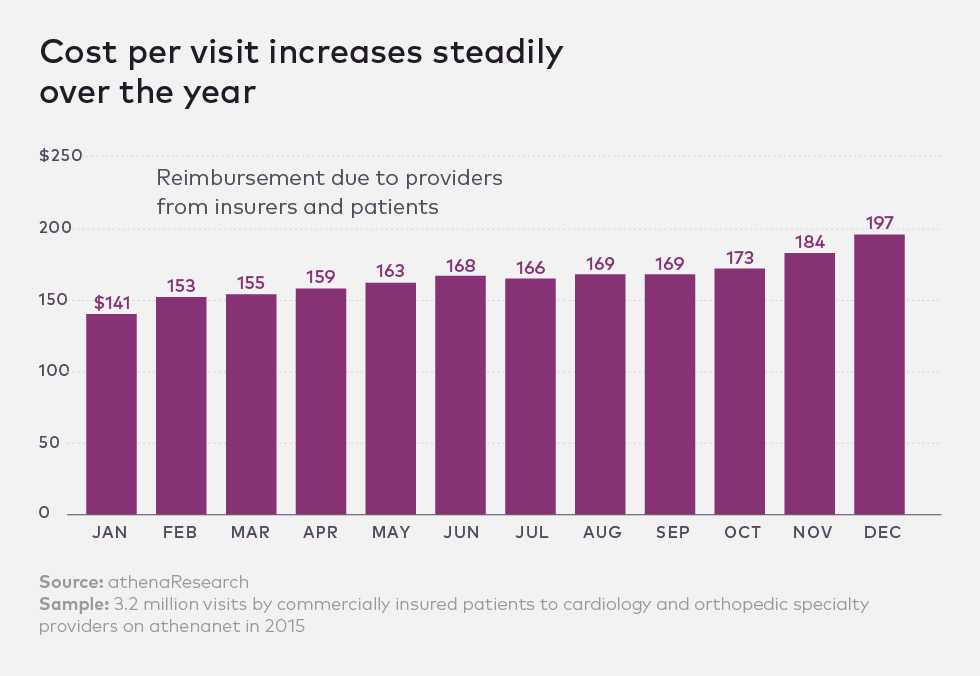

Reimbursement per visit for these practices, meanwhile, tends to track in the opposite direction — most likely as patients who have met their deductibles come in for expensive care that is more fully covered by insurance. According to the data, providers make 37 percent more per patient visit in December than they do for each visit scheduled in January.

The implication for anyone keen on survival? A sure way to maximize overall revenue is to have a strong strategy for collecting patient payments in the spring.

Collecting up front

“For us, the first quarter's always slow, and the last few months are crazy," says Lynn Wolff, CEO of Georgia Hand Shoulder Elbow, an Atlanta-based orthopaedic group with a 92 percent patient pay yield. In January and February, Wolff notes, people with carpal tunnel and other non-emergency conditions "just figure they can live with it until they make up their deductible somewhere else."

But that's not how it works come October and November, Wolff says. “By then they've met most of their out-of-pocket obligations, and we don't have enough surgical days to get everybody in."

While it's great to be busy in the fall, Wolff adds, the seasonal nature of surgical revenue puts pressure on her team after New Year's.

For appointments scheduled in these early months, when out-of-pocket payments often cover the entire bill, “we can't afford to be chasing the money," she says. “So we make sure our patients know what they're going to be responsible for, and we always ask them to pay up front."

Mikael Moore, CPC, CPCO, director of professional reimbursement at the San Antonio Orthopaedic Group, says her organization takes a similar approach with its patients, many of whom have deductibles they can barely afford to pay.

“Our CareCredit volume definitely goes up at the beginning of the year," she says.

After spring, those patient balances start to drop, Moore says, “but not nearly the way they used to." As deductibles and co-insurance requirements have risen, she explains, patients have been on the hook for more of their care costs deeper and deeper into the year. “At least in our case, that swing we've always seen is disappearing fast."

Still, Moore says, the earliest months of the year, when policies renew, are always the most critical in terms of patient collections.

“We know we need those payments before we get started, or we ultimately won't get paid for the work that we do," she says.

Toward that end, she says, the practice is refining its collection strategy, focusing on “a balancing act" of patient advocacy and education.

“We feel strongly that we should understand the patient's perspective and work with them however we can," Moore says. "But we're also a business; we have to make money."

Lynn Wolff at GHSE agrees. Any practice that hopes to keep its lights on — throughout the year — should make clear communication a part of its billing strategy.

“You have to take the time to get it right," she says. “You really don't have any other choice."